Footwear importation

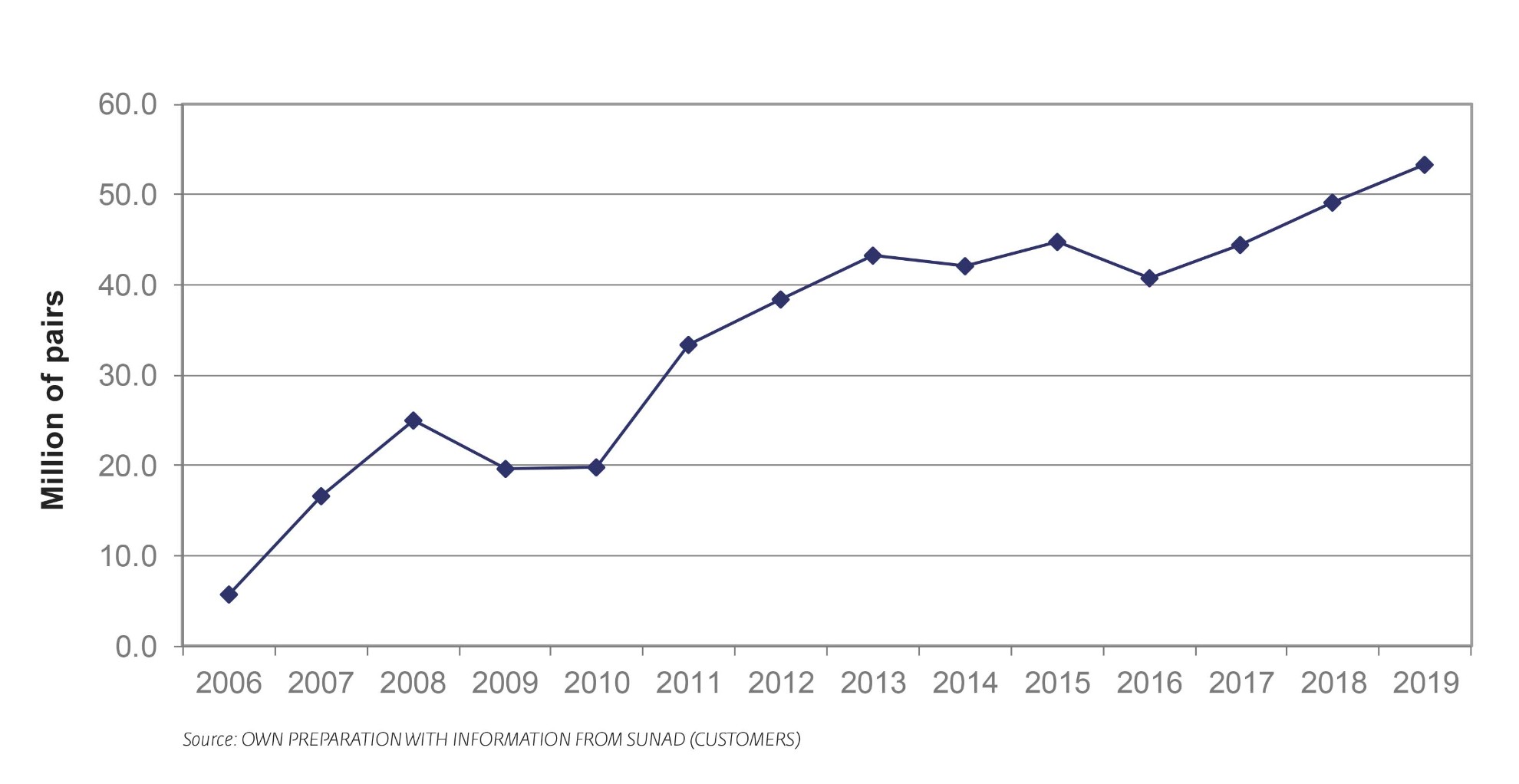

Imports compared from 2006 to 2019 have increased 9.3 times, as can be seen in figure 3.

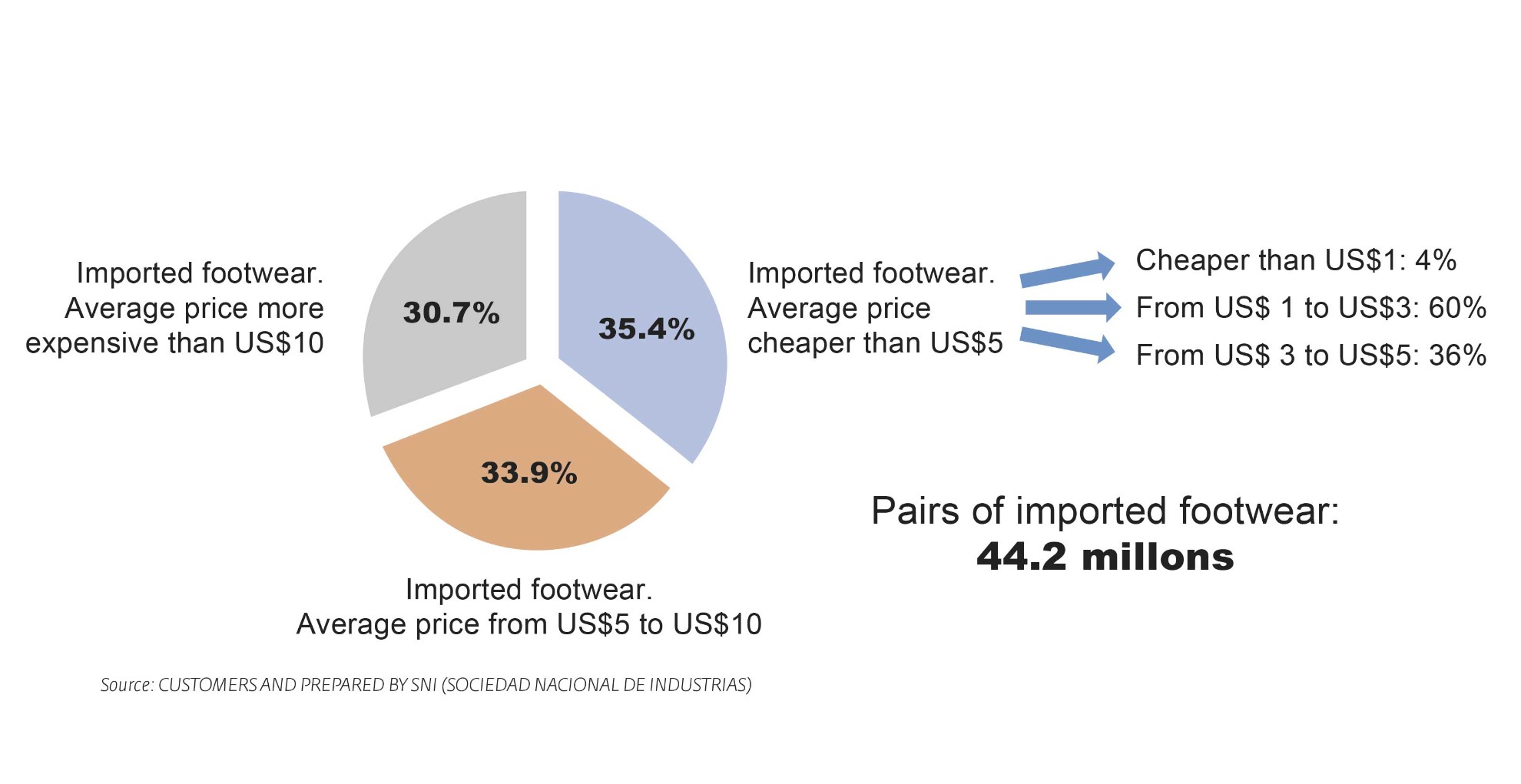

In 2019, imports represented 53.4 million pairs of footwear. These imports can be divided into three groups: those with prices below $ 5 dollars, which represents 35.4% of imports; the one that varies between 5 and 10 dollars and expresses 33.9%, and the one that has prices higher than 10 dollars, that represents 30.7%. These figures correspond to imports from January to October 2019, which at that time reached 44.2 million pairs to finally end at 53.4 million pairs, with no change in the percentage structure presented in figure 4.

Peru has the second lowest import tariff in the region, surpassed only by Chile. The average tariff in our country is 8.8%, compared to Brazil, Argentina and Bolivia that are above 30% and much higher than that of Ecuador is 74.5%.

National Production vs. Imports

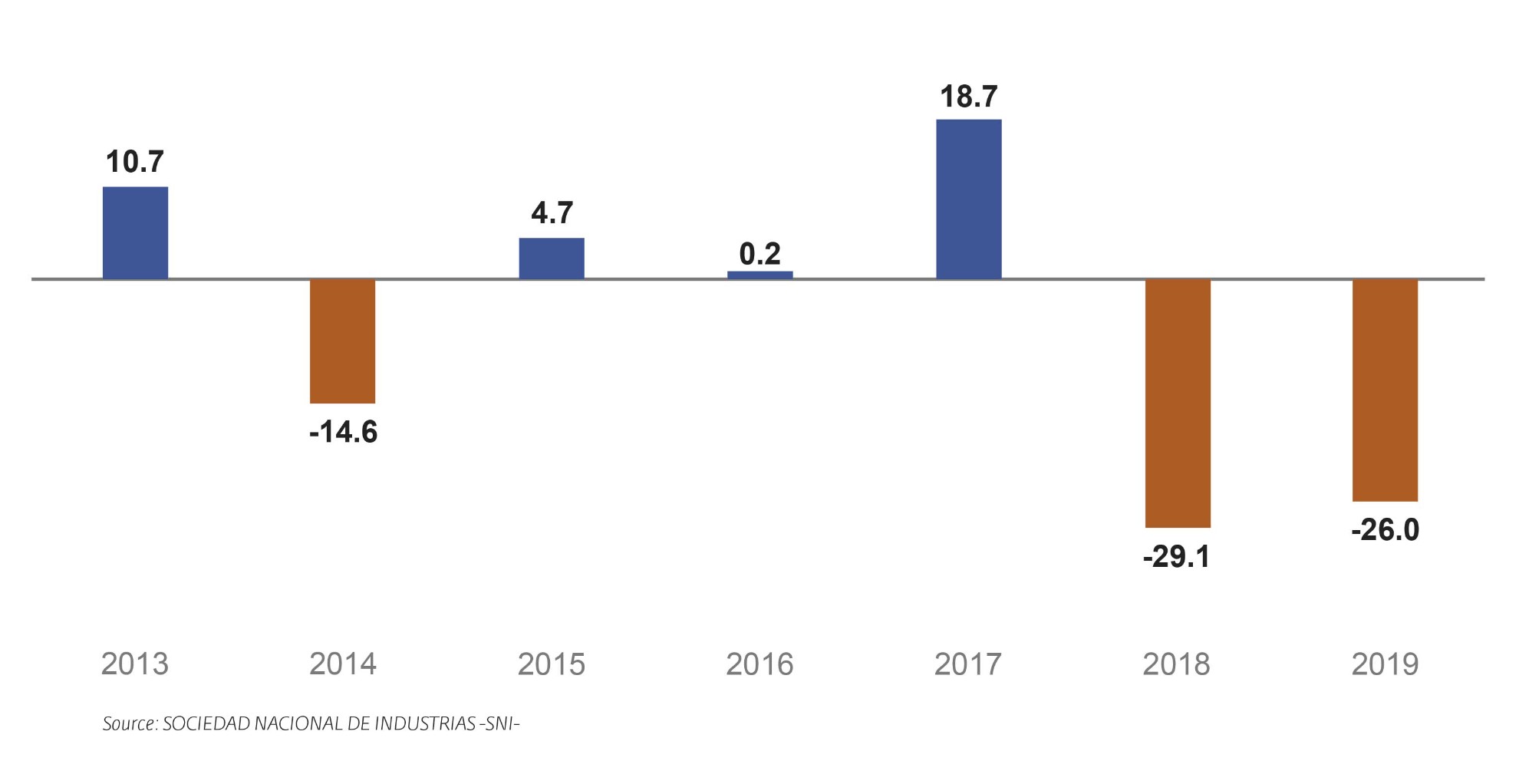

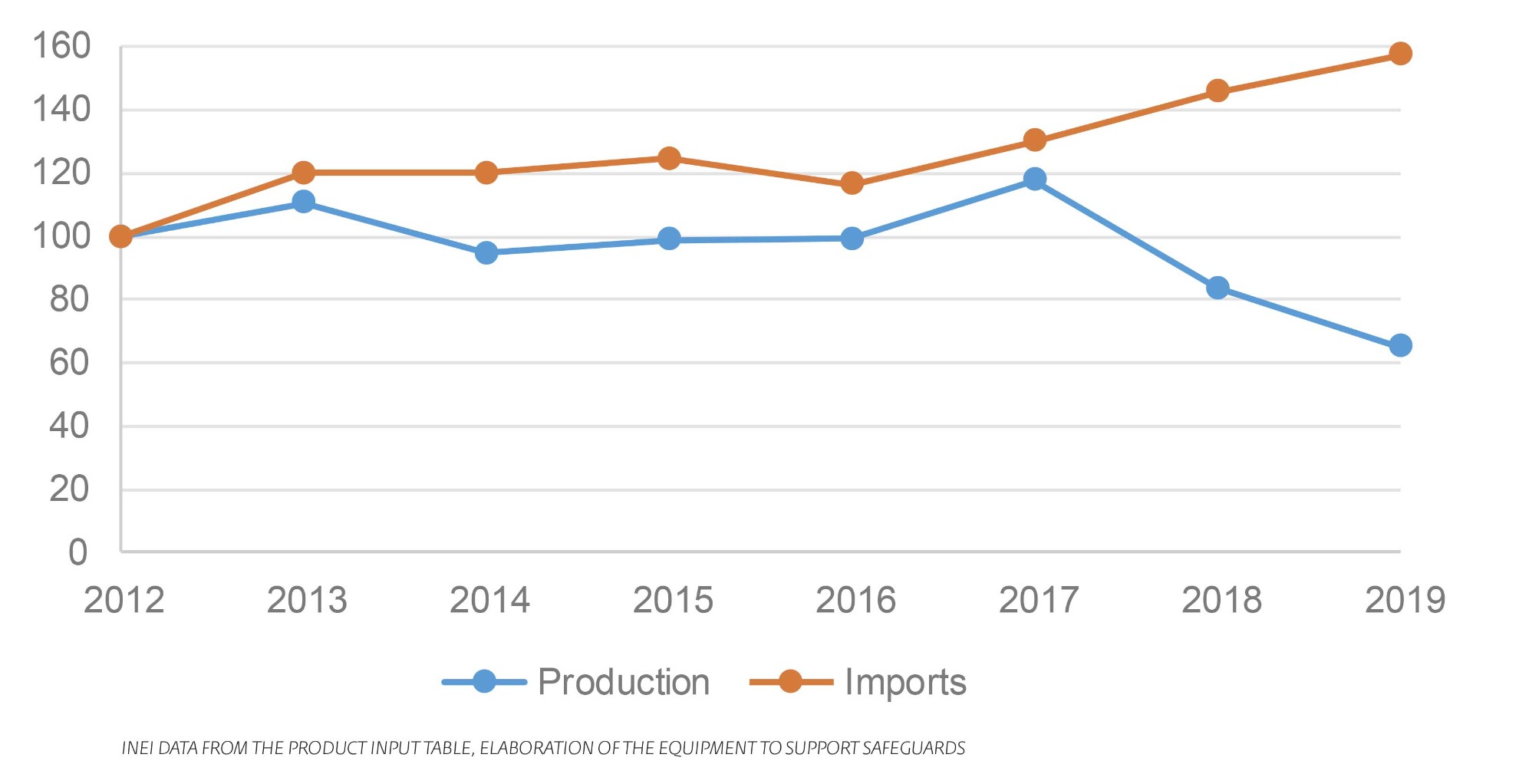

Taking the 2012 as the base year to determine the evolution of imports and domestic production, it can be seen, as through the years after the base year, the rate of imports was higher than that of domestic production, marking a greater difference from the year 2017.

As can be seen in figure 5, the import index for 2019 is close to 160 and that of national production is close to 60, this means that there is a strong deterioration in the participation of national production, from a ratio of 1 in 2012, has gone to a ratio of 2.6 (160/60) in 2019. This new expression may explain the greater presence of imported products, the strong drop in national production and the deterioration of the national product in the composition of the domestic consumption.

In this sense, almost 70% of national consumption is imported and 30% is national production. This increase not only displaces the national producer, but is also causing the closure of many companies, the idle installed capacity has increased, and the loss of many direct jobs. See graph 5.

Mainly, two direct and two indirect effects can be considered in the deterioration of the situation of the footwear sector in Peru. Direct effects, the first issue is the annulment of certain tariff headings with anti-dumping measures and other tariff deregulations, and secondly, the null control the entry of imported goods with unfair practices.

This situation favors the chain stores that import directly at the expense of small shops, which are the main buyers of domestic production. These latter through a serious financial crisis that hurts their suppliers, manufacturers of domestic footwear.

En referencia a los efectos indirectos, la desaceleración del crecimiento económico y la crisis política prolongada, están desfavoreciendo a los sectores que reciben las consecuencias inmediatas de una crisis, como es el sector manufacturero, dentro del cual el mayor perjudicado es confecciones y calzados.

Es menester señalar, que la limitada fiscalización aduanera, está creando mayores condiciones de competencia desleal, abriendo una puerta para el ingreso masivo sin control de los productos importados, lo cual crea mayores expectativas a los importadores.

Para evitar la quiebra masiva del sector

A la grave situación del sector CALZADOS que ya era muy preocupante al cierre del año 2019 con las cifras descriptas anteriormente, a partir de Abril y Mayo, debido a las medidas sanitarias vigentes por coronavirus, el estado del sector se ha agravado notablemente. Se encuentra semiparalizado y no hay cifras oficiales que muestren la verdadera situación, pero se considera que hay un alto porcentaje de paralización, con fábricas que están operando, con un mínimo de sus capacidades instaladas.

Actualmente se están tramitando ante los organismos correspondientes (Ministerio de Producción, ente rector del sector manufactura e INDECOPI, institución responsable de regular la competencia desleal), solicitudes que impongan medidas de salvaguardias para el sector calzados ante la grave situación. Hay riesgos de un masivo quiebre de empresas, y se está en pleno proceso de evaluación, a la espera de las medidas necesarias de salvataje, en caso contrario, el daño será irreversible.

CONCLUSIONS:

• The local FOOTWEAR sector is going through a serious crisis, which is manifested in the increasingly reduced participation in the national market. According to projections for this year, national consumption would be made up of 67% of imported product and 33% of national product, meaning that of every 3 pairs that are sold to the consumer, 2 are imported and 1 is national.

• The growing influx of imports, which represents an annual growth rate of 17% since 2010 to date, has had an impact on the domestic industry over the past 7 years, causing a decrease of 38% in production. It means that if 100 pairs were produced in 2012, 62 pairs occur today.

• Las importaciones en el año 2019 representaron 53.4 millones de pares, recordando que Perú cuenta con el segundo arancel más bajo de la región para las importaciones, después de Chile. El arancel en Perú es de un 8.8% promedio. En tanto, países como Brasil, Argentina y Bolivia poseen aranceles por encima del 30%.

• 35.4% of FOOTWEAR imports enter with prices lower than 5 dollars. Such a situation implies that it is practically impossible to compete against products of these headings, and they clearly express dumping practices. This is much more detrimental to groups of local manufacturers working with relatively higher prices.

• Insufficient and limited customs control allows importers to accommodate descriptions of products under tariff headings which have no anti-dumping measures. Only those considered sensitive to fraud in a tariff item are audited, despite the fact that there are 8 items with anti-dumping measures. It is estimated that more than 95% of FOOTWEAR dispatches are not inspected.

• The re-export of badly labeled FOOTWEAR was eliminated in 2015 and in the same way, in 2018 the control of labeling at customs was without effect. These measures encourage greater income from imports of certain types of products.

• The application of safeguards is the only hope for the FOOTWEAR sector in Peru, in the face of a market in recession and invaded by imported products, within a very complex political-economic scenario.

RELATED ARTICLE: